Regulators and analysts warn that surging participation brings bigger responsibilities around risk management, liquidity and transparency in CIS structures. The new CIS regulations clamp down on unapproved public pooling, require

Quarterly performance notes and media rankings have turned CIS results into public league tables, with money market, fixed-income, balanced and equity funds compared on effective annual yields and consistency. In

The Capital Markets Authority is using the Capital Markets (Collective Investment Schemes) Regulations, 2023 to drive product expansion while tightening oversight, approving at least eight new collective schemes and multiple

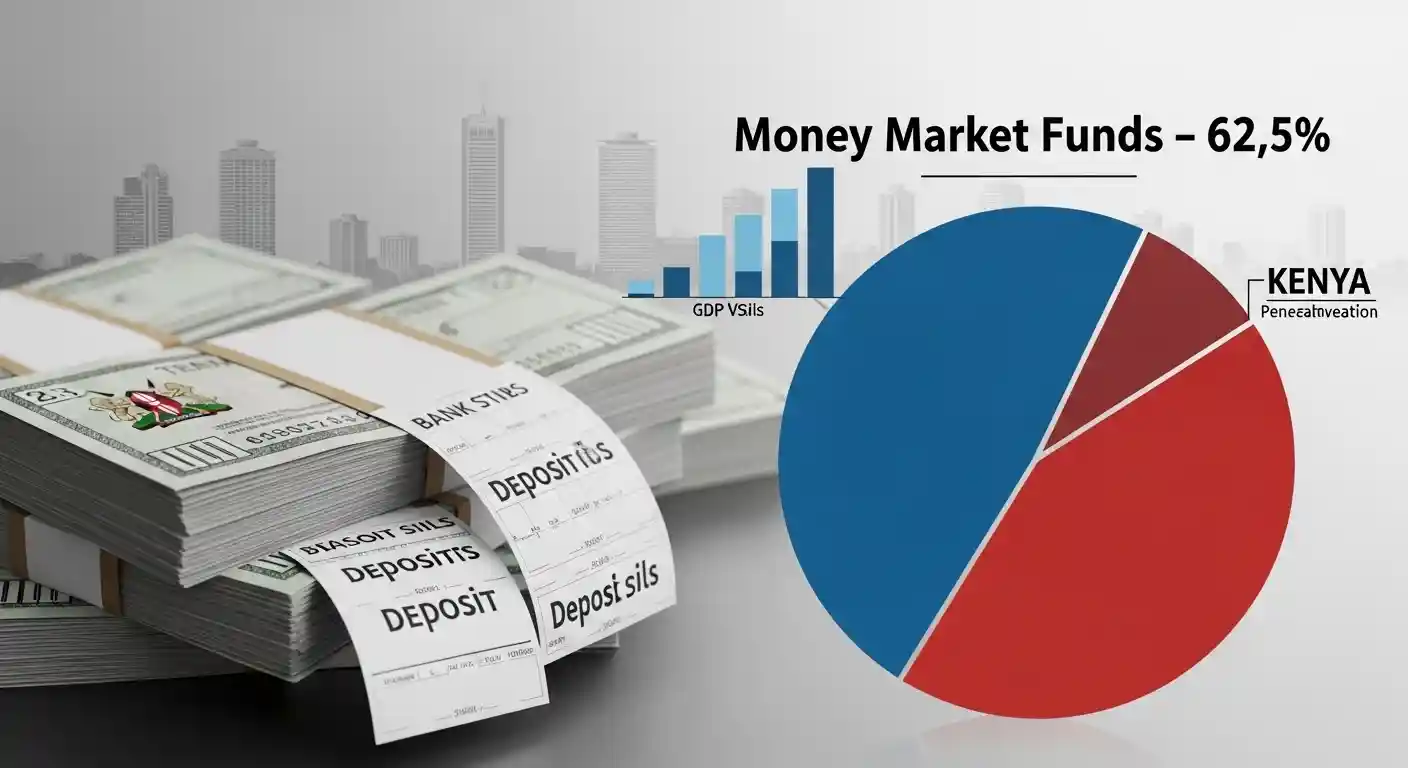

Money market funds (MMFs) dominate Kenya’s CIS landscape, controlling about KSh 373 billion—roughly 62.5 percent—of total CIS assets by Q2 2025, up from around KSh 320 billion just three months

The unit trust and CIS segment has become one of the fastest-growing corners of Kenya’s financial system, with assets under management climbing to about KSh 596 billion by Q2 2025,

With the new KESONIA-based pricing model taking effect and credit demand gradually recovering, markets are fixated on the CBK Monetary Policy Committee meeting scheduled in early December, which will set

Alongside high profits at the top tier, regulators are tightening the screws on under-capitalised lenders, with about 11 commercial banks reported to be at risk of licence revocation if they

Kenya’s major banks are closing 2025 on a high, with Q3 results showing broad-based profit growth anchored on higher interest income and improving asset quality. NCBA, DTB, I&M and other

The Central Bank of Kenya has warned that a tightening liquidity environment is straining the government’s capacity to service its fast-rising public debt stock, now in the KES 12 trillion

From December, Kenyan banks fully pivot to a revised risk-based credit pricing model that pegs all shilling variable-rate loans to the Kenya Shilling Overnight Interbank Average (KESONIA), plus a premium

Our Areas of Coverage

Banking

Insurance

Investment

Trade &Industry

Events

Sectors

Explore Reports, Data & Resources to Power Your Decisions

Explore a world of insights in our Data Hub. Access reports, trends, and essential data to fuel your next big move.