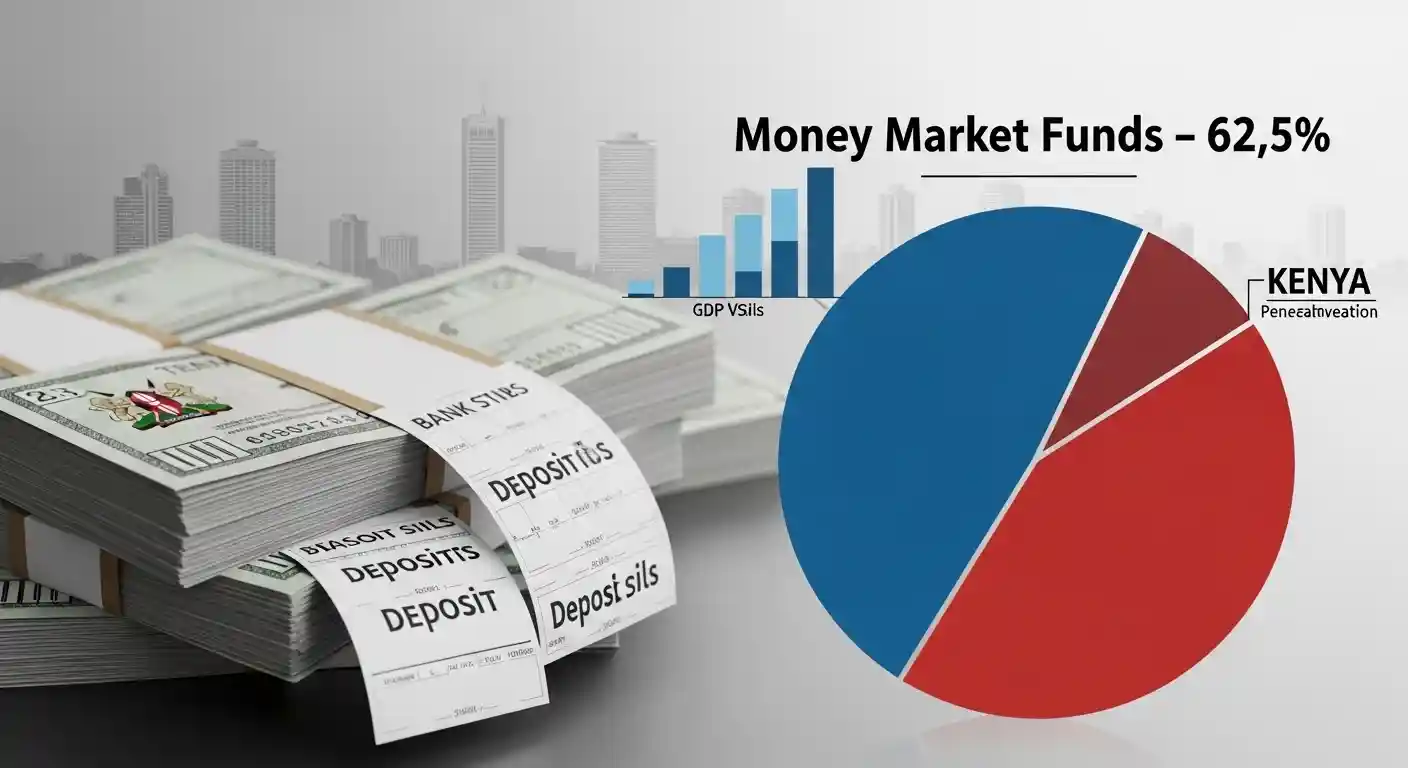

Money market funds (MMFs) dominate Kenya’s CIS landscape, controlling about KSh 373 billion—roughly 62.5 percent—of total CIS assets by Q2 2025, up from around KSh 320 billion just three months earlier. Dozens of licensed MMFs are offering effective annual yields in the high single digits to mid-teens, drawing both retail savers and corporate treasuries seeking a liquid, capital-preserving parking bay.

Yet despite this dominance, MMF assets represent only about 2.3 percent of GDP, far below a global average near 8.8 percent, and total mutual fund/CIS assets stand at roughly 3.7 percent of GDP versus more than 50 percent in mature markets. The large concentration in short-term products backed by bank deposits and government paper offers growth potential but also heightens sensitivity to interest-rate shifts, credit events and liquidity stresses, making portfolio construction a central story in 2026.